Colorado Metro Districts Explained: What Every Homebuyer Needs to Know

Buying a Home in Colorado? You Might Be Buying More Than a House

When you buy a home in Colorado, you are not just buying four walls and a roof. In many cases, especially with newer homes, you are also buying into a metropolitan district. These districts shape your property taxes, impact your monthly payments, and determine the maintenance of community infrastructure.

Here’s the kicker: the Colorado Real Estate Commission’s (CREC) approved contract actually includes a notice about special taxing districts. It is spelled out in Section 8.4. The problem is not that the disclosure is missing. The problem is that many real estate professionals either gloss over it or do not explain it in plain terms. Buyers end up signing contracts without fully realizing what it means.

What Are Special Districts and Metro Districts?

The term special district is broad. It refers to a local government entity created to provide a specific public service within a defined geographic area. They step in when cities, counties, or the state do not provide a particular service.

Examples of special districts you are probably already familiar with include:

-

School districts

-

Fire protection districts

-

Library districts

Each of these falls under different sections of Colorado law.

A metropolitan district is one type of special district, created under Title 32 of Colorado Revised Statutes. To qualify as a metro district, the entity must provide at least two public services. These services can include:

-

Streets, sidewalks, and road maintenance

-

Sewer, water, and sanitation

-

Stormwater systems

-

Parks, trails, and recreational amenities

-

Street lighting and landscaping

-

Covenant enforcement

Metro districts are the backbone for many new neighborhoods. They finance, build, and maintain the public infrastructure that makes a community livable. Without them, cities and counties would often not approve large-scale developments because they cannot absorb the cost of new infrastructure.

Why Metro Districts Exist: The TABOR Factor

Colorado’s Taxpayer Bill of Rights (TABOR) limits the ability of local governments to raise taxes without voter approval. That means cities and counties cannot just increase taxes to cover the costs of new developments.

Developers solve this by forming metro districts, which can issue tax-exempt municipal bonds. These bonds pay for the upfront costs of roads, sewer lines, storm drains, and other essentials. The bonds are then repaid over 20 to 40 years through higher property taxes collected from the homeowners in that district.

So when you buy into a metro district, your taxes are essentially helping repay the loan that built your neighborhood’s infrastructure.

Metro Districts vs. HOAs: Who Does What?

Here’s where buyers get confused. Some neighborhoods have both a Homeowners Association (HOA) and a Metro District. Some have only one. And the responsibilities can be complex to distinguish.

-

HOAs: These are private organizations. They usually enforce covenants (rules on paint colors, landscaping, parking, etc.) and maintain shared amenities like pools or clubhouses. They collect dues directly from homeowners.

-

Metro Districts: These are public entities. They collect money through property taxes, not monthly dues. They handle infrastructure and, in some cases, also enforce covenants.

The key takeaway is that every neighborhood is different. In some, the HOA enforces covenants. In others, the metro district handles it. And in some cases, both exist and share responsibilities.

It is critical to read the agreements and governing documents to know exactly who is responsible for what.

How Metro Districts Are Created and Governed

The process is governed by the Special District Act. Here’s the basic flow:

-

Service Plan: Developers submit a detailed plan to the city or county. This includes tax caps, debt limits, service areas, and the number of board members.

-

Public Hearing: Local officials review the plan and typically approve it in a public meeting.

-

Board Formation: In the beginning, the developer controls the board since they own all the land. Once homes are sold, residents can run for board positions during elections, which occur every odd-numbered year in May.

What Buyers Should Ask Before Closing

Do not stop at “What is the HOA fee?” If you are buying in a metro district, dig deeper:

-

What is the current mill levy (to determine the taxable amount), and how long is it expected to stay at that rate?

-

Has the district paid off its debt, or are homeowners still paying down bonds?

-

What amenities or services does the district maintain?

-

Does a separate HOA exist, and if so, what does it cover?

-

Can residents attend board meetings or run for a board seat?

Get your hands on the Service Plan! This is an extremely important document, and I cannot stress that enough. The details of how high the mill levy can go, and under what conditions, are spelled out in the Service Plan.

Phases of a Metro District

A metro district typically goes through two stages:

-

Build and Debt Phase: Higher property taxes cover repayment of municipal bonds. This stage typically lasts 20 to 40 years.

-

Maintenance Phase: Once the debt is paid, the mill levy often decreases, though some revenue may continue for ongoing services like landscaping or snow removal.

Legislative Reforms: HB 24-2667 and More

In 2024, HB 24-2667 brought important changes:

-

Metro districts can no longer foreclose on homes for unpaid covenant fines or fees.

-

Districts must adopt written fine policies with dispute resolution options.

-

Homeowner rights expanded to include displaying flags, using rain barrels, installing solar systems, and taking fire mitigation measures without fear of violations.

Other recent laws include:

-

SB 21-262: Requires annual reports, websites, public election notices, and limits eminent domain.

-

SB 23-110: Caps mill levies and debt, requires annual townhalls, and mandates disclosure of metro district status in all property sales.

How to Research a Metro District

Colorado provides several tools for buyers:

- Colorado Metro District Data Portal - Interactive Map of Metro Districts

- DOLA Local Government Information System - Here you can find service plans, debt, mill levies, and board member information.

Why It Matters for Your Wallet — and Your Home Search

Here’s where the rubber meets the road. Two homes might look identical on paper — same price tag of $500,000 — but if one sits in a metro district, you could be paying hundreds more every month in property taxes. That’s money coming directly out of your budget.

Over the life of a 30-year mortgage, those “additional” taxes can add up to tens of thousands of dollars in lost buying power. Lenders factor property taxes into your monthly escrow, which means a higher tax bill could actually shrink your loan approval amount. In plain English: the taxes tied to a metro district might knock you out of the running for a house you otherwise could have afforded.

This is why getting pre-approved with a trusted mortgage professional is so important. A good lender will run the numbers with metro district taxes included, so you know your true buying power before you start shopping. Click here to get started with a trusted local lender and get pre-approved today.

This isn’t hypothetical. I’ve walked buyers through this tax math many times. For VA buyers and first-time homeowners especially, it can make or break a deal. Imagine finding your dream home, only to learn that the district’s taxes bump your payment too high for the lender’s approval. That’s not a fun conversation.

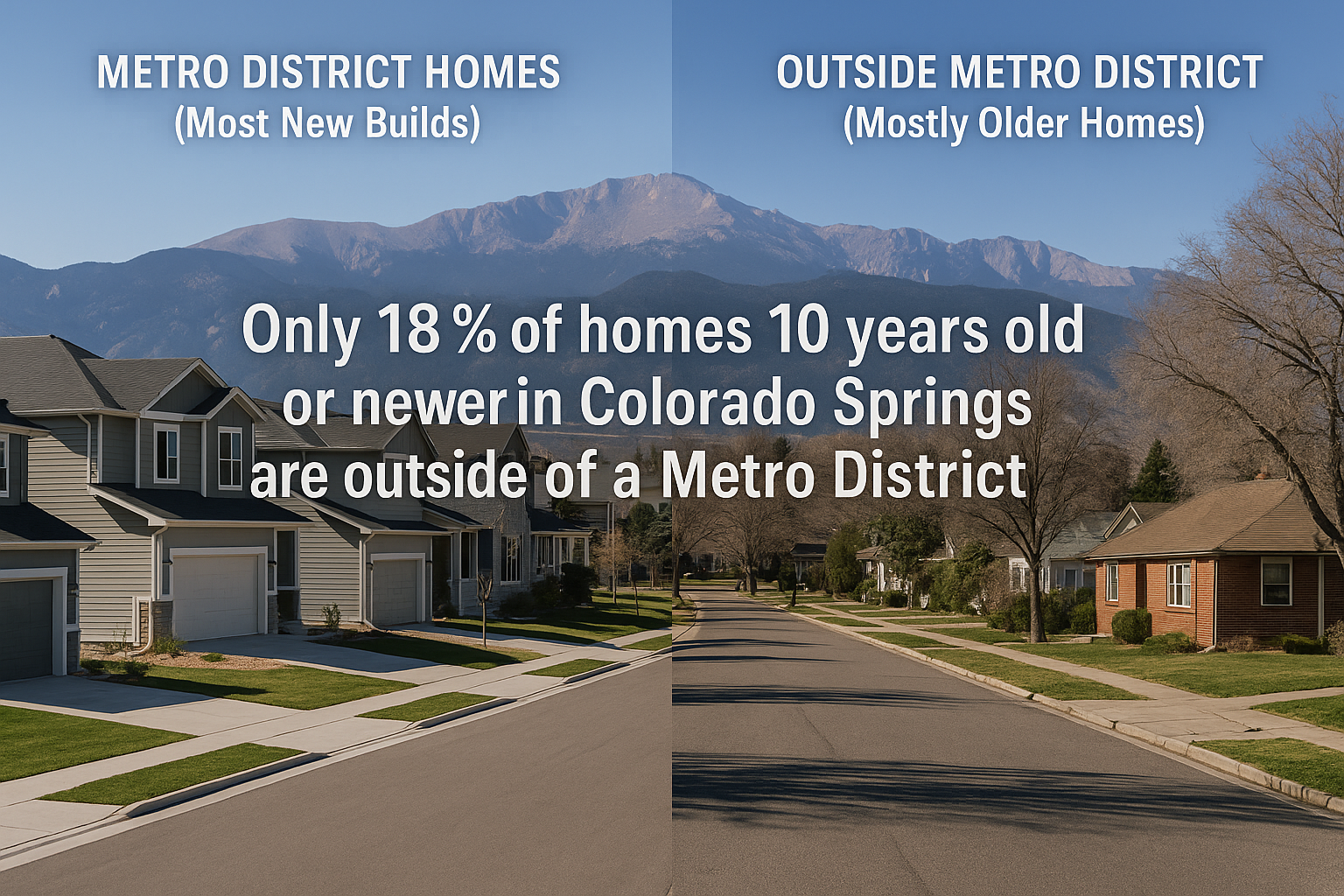

Here in Colorado Springs, the numbers speak for themselves:

-

Only about 18 percent of homes built in the last 10 years are outside a metro district.

-

At the time of this writing, just 36 percent of active listings built after 2000 are free of metro districts.

If avoiding metro districts is a dealbreaker for you, be prepared to focus your search on older homes , often 25 years or more. That trade-off may save you in taxes, but it can mean higher maintenance costs.

This is why understanding metro districts is not just a legal box to check. It’s a financial strategy that directly impacts your bottom line, your monthly comfort, and your long-term equity.

Why This Can Actually Be a Smart Financial Move

Here’s the real deal: metro districts might save you money over time, not just cost you more. Because they issue tax-exempt municipal bonds to pay for infrastructure (roads, sewers, parks) homeowners often get lower interest rates than those tied to other financing methods. That means infrastructure gets built fast, up front, and without inflating home prices.

-

Tax-exempt bonds stretch costs over decades, which enhances purchasing power from day one Town of Timnath.

-

It's often more cost-effective than impact fees or lump-sum assessments you'd otherwise see from city or HOA models hbacolorado.com.

-

That saved cost can translate to tens of thousands in equity or affordability edge, over the full lifecycle of the district.

So yes, at closing and when you receive your tax statement in the mail, the taxes may look high. But if the district’s service plan shows well-managed debt and a predictable mill-levy schedule, you might actually come out ahead of the curve compared to neighborhoods that tack these costs onto home sale prices upfront.

Final Thoughts

Metro districts are not inherently bad, but they are often misunderstood. They are a powerful financing tool that allows neighborhoods to exist, but they come with long-term costs that buyers must account for.

If you are serious about buying in Colorado, do not overlook this part of the contract. Read it. Ask questions. Compare tax impacts. It could mean the difference between staying within your budget or stretching it too thin.

Ready to Explore Your Options?

Understanding metro districts is only half the battle. The other half is knowing how they affect your budget, your monthly payment, and your long-term equity. That is where I can help.

📞 Let’s schedule a consultation to talk about your goals, compare neighborhoods inside and outside metro districts, and run real tax comparisons so you can make a confident decision.

👉 Click here to connect and register today

Ryan Meyer

Realtor®, eXp Realty

Greater Colorado Springs Area, CO

📱 719-723-1755

📧 ryan.k.meyer@exprealty.com

🌐 mountaincityliving.com

FAQs: Metro Districts in Colorado

1. Is the notice about metro districts already in the contract?

Yes. Section 8.4 of the CREC contract spells it out. The problem is that many buyers and even agents skim past it without truly understanding the long-term tax implications.

2. What is the difference between an HOA and a metro district?

HOAs are private and collect dues. Metro districts are public and collect property taxes. Some neighborhoods have both, and in certain cases, the metro district itself enforces covenants.

3. Can the mill levy increase after I buy my home?

Yes. If the district faces financial issues or needs to cover debt, the mill levy can rise, which directly increases your property taxes. The details of how high it can go, and under what conditions, are spelled out in the Service Plan. Make sure your Realtor obtains a copy during your due diligence period so you know exactly what risks and caps are in place before you close.

4. How do I know if a home is in a metro district?

Check the Certificate of Taxes Due from the County Treasurer’s website or use the DOLA and State Metro District portals. Your agent should also help you review this. This shows each taxing authority on the property. You can also use Colorado’s Colorado Metro District Data Portal to look up district boundaries and details. Your Realtor should walk you through these resources during due diligence so you know exactly what you are buying into.

5. What happens when a metro district pays off its debt?

Ideally, the mill levy decreases. In practice, some districts maintain a smaller levy to cover services like snow removal or landscaping.

6. Can I participate in metro district governance?

Yes. Homeowners can attend meetings and run for the board in the next election, which occurs every odd-numbered year in May.

Categories

- All Blogs (2)

- Builder Incentives (1)

- Buy vs Build (1)

- Colorado Springs Housing Market (1)

- Colorado Springs Real Estate (1)

- Home Buying Tips (1)

- Homeowners Associations (1)

- Househacking (1)

- Loan Assumptions (1)

- Metropolitan Districts (1)

- Military Homebuyers (1)

- Military PCS (1)

- Mortgage & Financing (1)

- New Construction Homes (2)

- Rate Buydowns (1)

- Special Taxing Districts (1)

- VA & FHA Loan Strategies (1)